This particular style of budgeting is best for businesses, but could be useful for families. This type of budget allows you to see where you are spending the majority of your money. Business Dictionary defines line-item budgeting as:

“A budget in which the individual financial statement items are grouped by cost centers or departments. It shows the comparison between the financial data for the past accounting or budgeting period and estimated figures for the current or a future period.” – Business Dictionary

Basically this means that you can group several things that are similar to see how much it is costing you in whole. An example of this would be grouping everything to do with your animals together: food, veterinary services and grooming. This will let you know the entire cost for your animals. Even though not all of these are the same, they all deal with your animals.

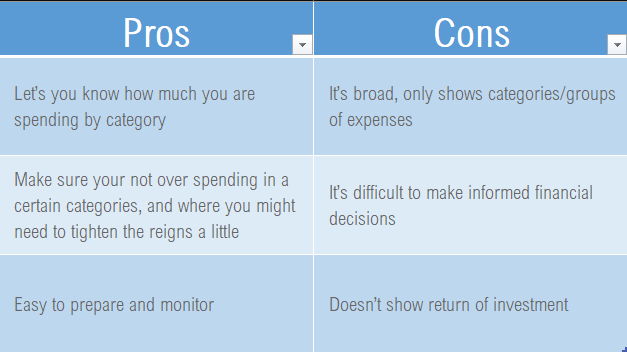

This style lets you know where your money is going in the whole, there are some pros and cons you will want to consider before using this type of budget.

This budget is good if you are wanting to know what part of your finances are costing you the most. If your goal is to get out of debt or just save money, this probably isn’t the best budgeting style for you. If are trying to get out of debt or just save money try zero sum budgeting linked here.

This budgeting style works best if you have a good and complete understanding of your finances and want to see where you could be over spending. This style is less of micromanaging budgeting tool and more big picture. Most families just starting out probably won't want to start with this style.

If you are just starting out you will probably want to know where every penny is going specifically, and this budget simply does not do this.