The Snowball Method: A Powerful Strategy to Pay Off Debt Faster

If you're feeling overwhelmed by debt and not sure where to start, you're not alone. Many people struggle to find an effective and sustainable way to tackle their financial burdens. One of the most popular—and psychologically rewarding—approaches is the Debt Snowball Method.

What is the Snowball Method?

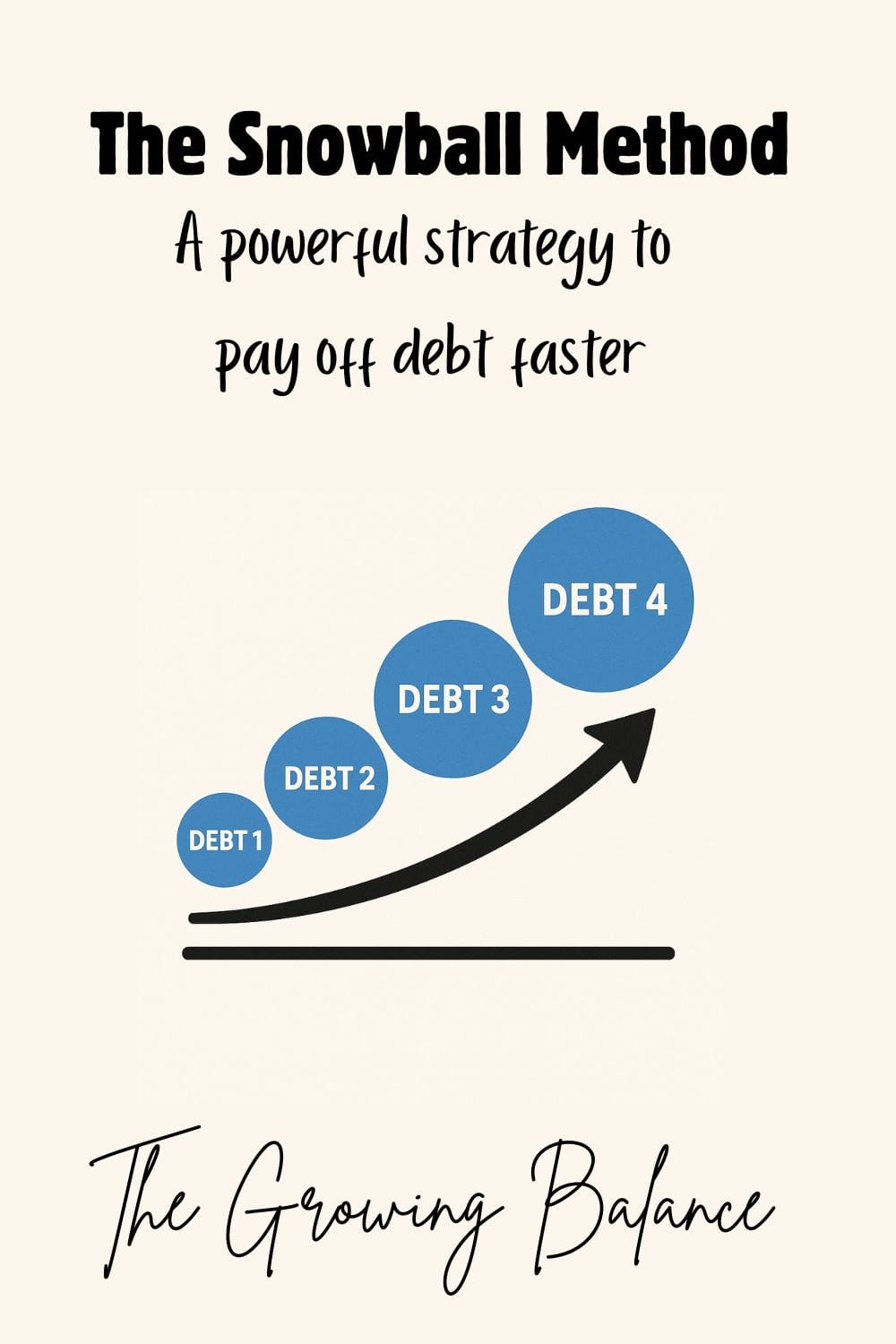

The Snowball Method is a debt repayment strategy that focuses on paying off your smallest debts first, while continuing to make minimum payments on all other debts. Once a small debt is paid off, you take the money you were using for that payment and apply it to the next smallest debt. Over time, the amount you’re paying toward your debts “snowballs,” gaining momentum as each balance is wiped out.

It’s less about numbers and more about psychological motivation. By giving you small wins early on, the Snowball Method helps build the confidence and discipline needed to stay committed to your debt-free journey.

This is the method that my husband and I have used in the past. What a rush when you pay off that first loan off, and your done with it forever. We did this and ended up paying our car off over a year early. You'd be surprised how fast you can pay something off when you add just a little to the loan.

How the Snowball Method Works: Step-by-Step

- List All Your Debts

- Include credit cards, personal loans, student loans, and any other debts.

Record the total balance, minimum monthly payment, and interest rate for each.

- Organize Debts by Balance

- Order them from the smallest balance to the largest, regardless of interest rate.

- Make Minimum Payments on All Debts

- Continue making minimum payments on every debt to avoid penalties and keep accounts in good standing.

- Put Extra Money Toward the Smallest Debt

- Use any extra funds—side income, bonuses, or budget cuts—to aggressively pay off the smallest debt.

- Roll Over Payments to the Next Debt

- Once the smallest debt is paid off, roll that payment into the next smallest debt. This increases the payment amount and accelerates progress.

- Repeat Until All Debts Are Paid Off

- Each debt you eliminate frees up more cash flow for the next one, creating a powerful compounding effect.

Example of the Snowball Method in Action

Let’s say you have the following debts:

| Debt Type | Balance | Minimum Payment |

|---|---|---|

| Credit Card A | $500 | $25 |

| Medical Bill | $1,200 | $50 |

| Personal Loan | $3,000 | $150 |

| Student Loan | $8,000 | $200 |

With the Snowball Method:

- You focus on Credit Card A first, paying more than the $25 minimum—say, $200 a month—until it’s paid off.

- Then you move to the Medical Bill, now paying $250 a month ($200 from the credit card plus $50 minimum).

- Continue rolling payments up the list until all debts are eliminated.

Why the Snowball Method Works

- Psychological Wins: Quickly eliminating small debts feels good. That positive reinforcement keeps you motivated.

- Builds Momentum: Like a snowball rolling downhill, your payment power grows with every debt you eliminate.

- Simple to Follow: You don’t need to worry about complex interest calculations or financial formulas.

When the Snowball Method Might Not Be Ideal

If you have a large high-interest debt, the Avalanche Method (which targets high interest rates first) might save you more money in the long run. However, many people find it harder to stick with the avalanche approach because progress feels slower at first.

The Snowball Method is ideal if:

- You need quick wins to stay motivated.

- You’re dealing with multiple smaller debts.

- Your debt has similar interest rates.

Tips to Maximize the Snowball Method

- Track Your Progress: Use a spreadsheet or debt payoff app to visualize your shrinking balances.

- Cut Unnecessary Expenses: Redirect those savings into your snowball payments.

- Earn Extra Income: Use side gigs or freelance work to boost your payment amounts.

- Avoid New Debt: Put a pause on credit card use or unnecessary borrowing.

Final Thoughts

The Snowball Method is a powerful tool—not because it always saves the most money in interest, but because it works with your behavior. It gives you small wins, keeps you focused, and helps you build confidence in your ability to manage your money. For many people, that's the key to breaking the cycle of debt once and for all.

If you're struggling with where to start, try the Snowball Method—you might be surprised how quickly a few small wins can turn into big victories.

Need to start a budget to figure out how much money you make and where you spend the most? Try